8.1 Taxes on acquisition of motor vehicles in EU countries, January 2017

| Country | VAT | Registration Tax |

|---|---|---|

| AT | 20% | Based on CO2 emissions (max 32% + bonus/malus) |

| BE | 21% | “Based on cylinder capacity and age (Brussels-Capital) Fuel, age, Euro standards and CO2 emissions (Flanders) CO2 emissions (Wallonia)” |

| BG | 20% | Based on purchase price + BGN 25 (plate) + BGN 160 (eco tax) |

| HR | 25% | Based on selling price and CO2 emissions |

| CY | 19% | Based on CO2 emissions and cylinder capacity |

| CZ | 21% | Based on vehicle type and Euro standards |

| DK | 25% | Based on traffic safety equipment and evaluation (105% up to DKK106,600 + 150% on the remainder) |

| EE | 20% | €62 (registrationlabel) + €130 (registration card) |

| FI | 24% | Based on price and CO2 emissions (min 3.8%, max 50%) |

| FR | 20% | Bonus/malus system based on CO2 emissions |

| DE | 19% | Based on purchase price + €26.30 (registration fees) |

| EL | 24% | Based on net retail price and CO2 emissions |

| HU | 27% | Based on age and cylinder capacity |

| IE | 23% | Based on CO2 emissions, from 14 to 36% |

| IT | 22% | Based on kilowatt, weight and seats |

| LV | 21% | Based on weight and fuel type |

| LT | 21% | Based on vehicle type |

| LU | 17% | Based on purchase price + registration fees (€24 or €50) |

| MT | 18% | Based on CO2 emissions, length and vehicle value |

| NL | 21% | Based on CO2 emissions and fuel efficiency |

| PL | 23% | Based on cylinder capacity (3.1-18.6%) |

| PT | 23% | Based on cylinder capacity and CO2 emissions |

| RO | 19% | Based on purchase price + €9 (registration fees) |

| SK | 20% | Based on engine power (kW) and age |

| SI | 22% | Based on CO2 emissions and purchase price |

| ES | 21% | Based on CO2 emissions,from 4.75% (121-159g/km) to 14.75% (200g/km or more) |

| SE | 25% | Based on purchase price and vehicle type |

| UK | 20% | Based on invoice value or resale price |

Source: ACEA

8.2 Fiscal income from motor vehicles in EU selected countries, 2015 (EUR billion)

| TOTAL EU | AT | BE | DK | DE | ES | FI | FR | EL | IE | IT | NL | PT | SE | UK | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| € bn | € bn | DKK bn | € bn | € bn | € bn | € bn | € bn | € bn | € bn | € bn | € bn | SEK bn | £bn | |||

| 2014 | 2015 | 2014 | 2012 | 2015 | 2015 | 2014 | 2013 | 2015 | 2015 | 2015 | 2016 | 2014 | 2016** | |||

| VAT on vehicles, servicing/ repair parts, tyres | 2,68 | 6,23 | NA | 26,32 | – | 1,50 | 13,74 | 0,16 | 0,60 | 16,10 | 1,52 | 3,45 | 24,50 | 12,50 | ||

| Fuels & Lubricants | 5,34 | 6,93 | 16,61 | 39,30 | 18,72 | 4,07 | 37,10 | 3,77 | 3,03 | 36,84 | 7,87 | 3,26 | 48,20 | 27,90 | ||

| Sales & registration taxes | 0,52 | 0,41 | 15,87 | – | 3,79 | 0,88 | 2,07 | 0,05 | 0,68 | 1,52 | 1,46 | 0,67 | – | – | ||

| Annual ownership taxes | 2,10 | 1,60 | 10,59 | 8,99 | 2,64 | 0,93 | 1,00 | 1,30 | 1,12 | 5,95 | 3,97 | 0,55 | 14,30 | 5,80 | ||

| Driving license fees | – | 0,01 | – | 0,01 | 0,06 | – | – | – | – | 0,25 | – | – | – | |||

| Insurance taxes | 0,32 | 0,96 | 1,58 | 3,79 | – | 0,39 | 4,59 | – | 4,00 | 0,95 | – | 2,80 | – | |||

| Tolls | 1,69 | – | 0,38 | – | – | – | 11,03 | n.a. | – | 1,95 | – | 0,32 | 1,80 | – | ||

| Customs duties | – | – | – | 0,54 | – | – | – | – | – | – | 0,05 | – | – | |||

| Other taxes | 0,31 | 0,66 | – | 1,01 | 0,66 | – | 1,58 | 0,06 | – | 5,50 | 2,39 | 0,20 | 4,50 | 1,50 | ||

| TOTAL (National currencies) | 12,96 | 16,80 | 45,02 | 79,96 | 25,86 | 7,77 | 71,11 | 5,34 | 5,44 | 71,86 | 18,41 | 8,50 | 96,10 | 47,70 | ||

| Total in EURO | 13,00 | 16,80 | 6,10 | 80,00 | 25,90 | 7,80 | 71,10 | 5,34 | 5,40 | 71,90 | 18,40 | 8,50 | 10,00 | 55,90 | ||

| Total = EUR 395.7bn |

Source: ACEA

* lates avialable data; only countries for which sourced data is avilable are listed

** 2012 estimates for income from VAT and other taxes

8.3 Excise duties on fuels in EU countries at 1-1-2015 & 1-1-2017 (EUR/1000 litres)

| 1 Jaunuary 2015 | 1 January 2017 | % change 2015-2017 | ||||

|---|---|---|---|---|---|---|

| Unleaded Petrol | Diesel | Unleaded Petrol | Diesel | Unleaded Petrol | Diesel | |

| AT | 515 | 425 | 482 | 397 | -6,4% | -6,6% |

| BE | 615 | 443 | 623 | 513 | 1,3% | 15,8% |

| DE | 670 | 486 | 655 | 470 | -2,2% | -3,3% |

| DK | 608 | 414 | 564 | 363 | -7,2% | -12,3% |

| EL | 416 | 383 | 700 | 410 | 68,3% | 7,0% |

| ES | 425 | 331 | 461 | 367 | 8,5% | 10,9% |

| FI | 681 | 506 | 703 | 530 | 3,2% | 4,7% |

| FR | 624 | 468 | 651 | 531 | 4,3% | 13,5% |

| HR | 479 | 374 | 519 | 412 | ||

| IE | 587 | 479 | 588 | 479 | 0,2% | 0,0% |

| IT | 728 | 617 | 728 | 617 | 0,0% | 0,0% |

| LU | 465 | 338 | 462 | 335 | -0,6% | -0,9% |

| NL | 759 | 478 | 772 | 486 | 1,7% | 1,7% |

| PT | 617 | 402 | 671 | 446 | 8,8% | 10,9% |

| SE | 646 | 602 | 405 | 260 | -37,3% | -56,8% |

| UK | 674 | 674 | 680 | 680 | 0,9% | 0,9% |

| BG | 363 | 330 | 363 | 330 | 0,0% | 0,0% |

| CY | 479 | 450 | 479 | 450 | 0,0% | 0,0% |

| CZ | 469 | 398 | 475 | 405 | 1,3% | 1,8% |

| EE | 423 | 393 | 465 | 448 | 9,9% | 14,0% |

| HU | 397 | 384 | 388 | 357 | -2,3% | -7,0% |

| LT | 434 | 330 | 434 | 330 | 0,0% | 0,0% |

| LV | 411 | 333 | 436 | 341 | 6,1% | 2,4% |

| MT | 519 | 422 | 549 | 472 | 5,8% | 11,8% |

| PL | 349 | 345 | 395 | 345 | 13,2% | 0,0% |

| RO | 461 | 430 | 368 | 337 | -20,2% | -21,6% |

| SI | 596 | 495 | 508 | 426 | -14,8% | -13,9% |

| SK | 551 | 386 | 515 | 368 | -6,5% | -4,7% |

| EU 28 average | 554 | 449 | 557 | 441 | 0,5% | -1,7% |

Source: ACEA

8.4 At the pump prices of petroleum in EU 28, first quarter of 2017* (€/litre)

8.6.1 At the pump prices of automotive diesel in EU countries, 2017 (€/litre)

| Austria | 1,09 |

| Belgium | 1,29 |

| Bulgaria | 1,03 |

| Croatia | 1,17 |

| Cyprus | 1,22 |

| Czech Republic | 1,12 |

| Denmark | 1,23 |

| Estonia | 1,16 |

| Finland | 1,27 |

| France | 1,22 |

| Germany | 1,15 |

| Greece | 1,27 |

| Hungary | 1,13 |

| Ireland | 1,28 |

| Italy | 1,39 |

| Latvia | 1,06 |

| Lithuania | 1,05 |

| Luxembourg | 0,96 |

| Malta | 1,18 |

| Netherlands | 1,18 |

| Poland | 1,06 |

| Portugal | 1,22 |

| Romania | 1,02 |

| Slovakia | 1,14 |

| Slovenia | 1,18 |

| Spain | 1,09 |

| Sweden | 1,39 |

| United Kingdom | 1,41 |

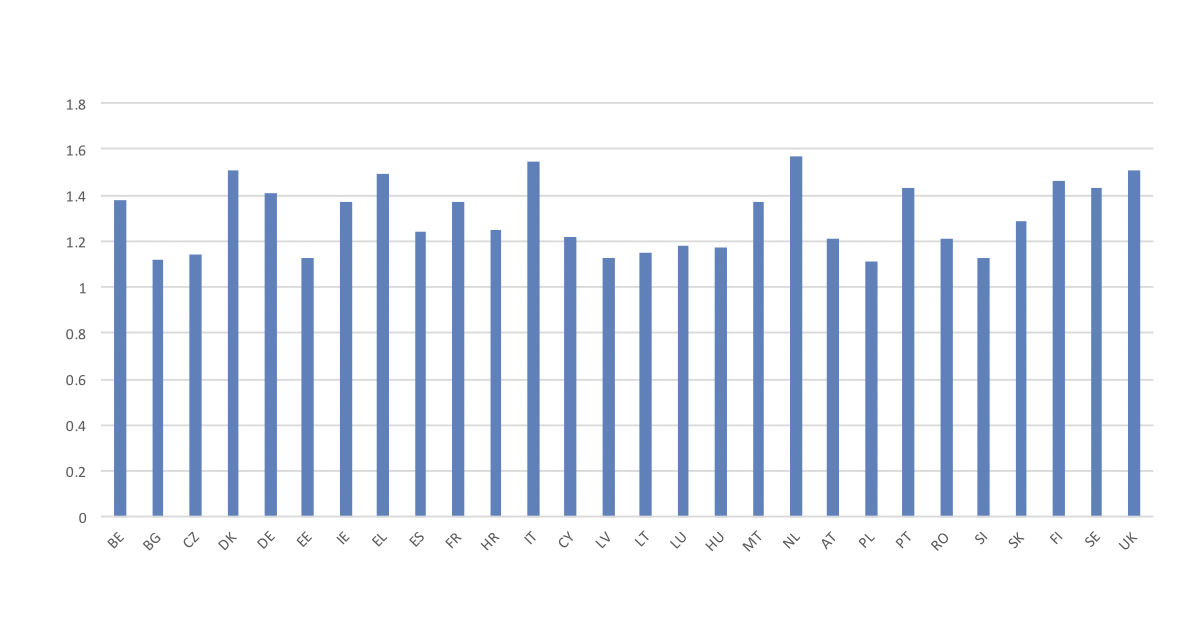

8.6.2 At the pump prices of premium unleaded gasoline 95 in EU countries, 2017 (€/litre)

| BE | 1,38 |

| BG | 1,12 |

| CZ | 1,14 |

| DK | 1,51 |

| DE | 1,41 |

| EE | 1,13 |

| IE | 1,37 |

| EL | 1,49 |

| ES | 1,24 |

| FR | 1,37 |

| HR | 1,25 |

| IT | 1,55 |

| CY | 1,22 |

| LV | 1,13 |

| LT | 1,15 |

| LU | 1,18 |

| HU | 1,17 |

| MT | 1,37 |

| NL | 1,57 |

| AT | 1,21 |

| PL | 1,11 |

| PT | 1,43 |

| RO | 1,21 |

| SI | 1,13 |

| SK | 1,29 |

| FI | 1,46 |

| SE | 1,43 |

| UK | 1,51 |

Source: DG ENER, Member States, * Average of the First 4 Months of 2012