8.1 Taxes on acquisition of motor vehicles in EU countries, January 2017

| Country | VAT* | Registration Tax | |||

| AT | 20% | Based on CO2 emissions (max 32% + bonus/malus) | |||

| BE | 21% | Based on cylinder capacity and age (Brussels-Capital) Fuel, age, Euro standards and CO2 emissions (Flanders) Cylinder capacity, age and CO2 emissions (Wallonia) |

|||

| BG | 20% | Plate costs (BGN 25) + eco tax (BGN 160) | |||

| HR | 25% | Based on purchase price, CO2 emissions and fuel type | |||

| CY | 19% | Based on CO2 emissions and cylinder capacity | |||

| CZ | 21% | Registration tax (max CZK 800) + eco tax based on emission standards | |||

| DK | 25% | 85% of vehicle’s value up to DKK 193,400 + 150% of the rest. Reductions based on safety equipment and fuel consumption. | |||

| EE | 20% | €62 (registrationlabel) + €130 (registration card) | |||

| FI | 24% | Based on retail value and CO2 emissions (min 2.7%, max 50%) | |||

| FR | 20% | Registration tax (varies by region) + CO2-based bonus/malus scheme | |||

| DE | 19% | Registration fees (€26.3) | |||

| EL | 24% | Based on net retail price, emissions technology and CO2 | |||

| HU | 27% | Based on cylinder capacity and emission standards | |||

| IE | 23% | Based basic price and CO2 emissions | |||

| IT | 22% | Based on vehicle type and horsepower + registration fees (+ €145.00) + CO2-based bonus/malus scheme | |||

| LV | 21% | Registration costs (€43.93) + national resources tax (€55) | |||

| LT | 21% | Based on vehicle type | |||

| LU | 17% | Registration stamp (€50) + supplement (€24 or €50) | |||

| MT | 18% | Based on vehicle’s value, CO2 emissions and length | |||

| NL | 21% | Based on CO2 emissions and fuel efficiency | |||

| PL | 23% | Based on cylinder capacity (up to 18.6% of vehicle’s value) | |||

| PT | 23% | Based on cylinder capacity and CO2 emissions | |||

| RO | 19% | Registration fees (€8.6) | |||

| SK | 20% | Registration fees (min €33 based on vehicle’s value, engine power and age) + plate costs (€16.5) | |||

| SI | 22% | Based on selling price, CO2 emissions and fuel type | |||

| ES | 21% | Based on CO2 emissions (max 14.75% for 200g/km or more) | |||

| SE | 25% | None | |||

| UK | 20% | First registration fee (£55) | |||

*Situation on 1 January 2019

Source: ACEA

8.2 Fiscal income from motor vehicles in EU selected countries, 2017 (EUR billion)

| TOTAL EU | AT | BE | DK | DE | ES | FI | FR | EL | IE | IT | NL | PT | SE | UK | ||

| € bn | € bn | DKK bn | € bn | € bn | € bn | € bn | € bn | € bn | € bn | € bn | € bn | SEK bn | £bn | |||

| 2016 | 2017 | 2017 | 2017 | 2017 | 2017 | 2017 | 2017 | 2015 | 2017 | 2017 | 2018 | 2017 | 2017/2018 | |||

| VAT on vehicles, servicing/ repair parts, tyres | 2,87 | 7,34 | NA | 30,32 | – | 1,67 | 17,85 | – | 0,60 | 18,26 | 1,31 | 4,21 | 25,00 | 12,50 | ||

| Fuels & Lubricants | 5,12 | 7,87 | 17,34 | 42,80 | 19,71 | 4,17 | 39,24 | 4,15 | 3,03 | 35,94 | 9,84 | 3,20 | 45,00 | 28,10 | ||

| Sales & registration taxes | 0,42 | 0,44 | 20,14 | – | 4,81 | 0,98 | 2,25 | 0,26 | 0,68 | 1,80 | 2,00 | 0,77 | – | – | ||

| Annual ownership taxes | 2,30 | 1,66 | 10,33 | 8,95 | 2,77 | 1,17 | 0,74 | 1,15 | 1,12 | 6,80 | 4,07 | 0,64 | 14,20 | 6,00 | ||

| Driving license fees | – | 0,02 | – | 0,17 | 0,06 | – | – | – | – | – | 0,27 | – | – | – | ||

| Insurance taxes | 0,34 | 0,98 | 1,52 | 4,50 | – | 0,37 | 4,84 | – | – | 3,85 | 1,07 | – | 2,90 | – | ||

| Tolls | 1,95 | 0,676 | 0,46 | 4,70 | – | – | 12,20 | – | – | 2,11 | – | 1,06 | 2,70 | – | ||

| Customs duties | – | – | – | 0,60 | – | – | – | – | – | – | – | – | – | – | ||

| Other taxes | 0,34 | 0,64 | – | – | 0,79 | – | 1,85 | 0,13 | – | 5,65 | 1,75 | – | – | 1,50 | ||

| TOTAL (National currencies) | 13,34 | 19,63 | 49,79 | 92,04 | 28,14 | 8,34 | 78,97 | 5,69 | 5,44 | 74,41 | 20,31 | 9,88 | 89,80 | 48,10 | ||

| Total in EURO ** | 13,30 | 19,60 | 6,70 | 92,00 | 28,10 | 8,30 | 79,00 | 5,70 | 5,40 | 74,40 | 20,30 | 9,90 | 8,60 | 56,30 | ||

| Total = EUR 427,6 bn | ||||||||||||||||

Source: ACEA

* lates avialable data; only countries for which sourced data is avilable are listed

** Euro foreign exchange reference rates at 3 April 2019; source: ECB

8.3 Revenues from environmentally related taxes in % of GDP

8.3.1 Environmental tax revenues by % of GDP in EU countries, 2017

% of GDP in EU(28) Countries

| Country code | 2017 |

| BE | 2,24 |

| BG | 2,7 |

| CZ | 2,07 |

| DK | 3,72 |

| DE | 1,81 |

| EE | 2,88 |

| IE | 1,75 |

| EL | 3,97 |

| ES | 1,83 |

| FR | 2,31 |

| HR | 3,43 |

| IT | 3,33 |

| CY | 2,92 |

| LV | 3,5 |

| LT | 1,91 |

| LU | 1,71 |

| HU | 2,53 |

| MT | 2,7 |

| NL | 3,33 |

| AT | 2,39 |

| PL | 2,68 |

| PT | 2,59 |

| RO | 1,91 |

| SI | 3,73 |

| SK | 1,76 |

| FI | 2,99 |

| SE | 2,16 |

| UK | 2,39 |

| EU 28 | 2,40 |

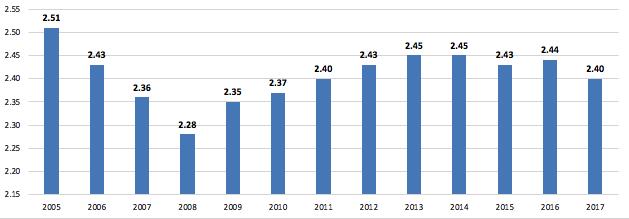

8.3.2 Evolution of environmental tax revenues by % of GDP in EU 28, 2005-2017

% of GDP in EU(28)

| 2005 | 2,51 |

| 2006 | 2,43 |

| 2007 | 2,36 |

| 2008 | 2,28 |

| 2009 | 2,35 |

| 2010 | 2,37 |

| 2011 | 2,40 |

| 2012 | 2,43 |

| 2013 | 2,45 |

| 2014 | 2,45 |

| 2015 | 2,43 |

| 2016 | 2,44 |

| 2017 | 2,40 |

source: OECD

8.4 CO2 based motor vehicle taxes in EU countries, 2018

| Country | CO2 based motor vehicle taxes in the EU in 2018 |

| Austria | A deduction of VAT is applicable for zero‐CO2 emission passenger cars. Fuel consumption/pollution tax (Normverbrauchsabgabe or NoVA) is levied on the purchase of a new car. It’s calculated as follows: [(CO2 emissions in g/km minus 90) divided by 5)] minus NoVA deduction, plus NoVA malus fee (ie €20 for each g/km of CO2 emission exceeding 250g/km). The company car tax is also based on CO2 emissions. |

| Belgium | Registration tax: – in Flanders is based on CO2 emissions as well as fuel, age and emission standards. – The Walloon Region operates a CO2‐based bonus/malus system whereby cars emitting 146g/km or more pay a penalty (max €2,500 for cars emitting more than 255g/km). The Flemish Region applies an environmental correction on the annual circulation tax depending on CO2 emissions, fuel type and emission standards. The Flemish Government also grants a so‐called Ecology Premium to companies that invest in environmentally friendly and/or energy‐efficient technologies (www.ecologiepremie.be). The deductibility under corporate tax of expenses related to the use of company cars is linked to CO2 emissions. |

| Croatia | The first registration of a motor vehicle is subject to the payment of a special tax based on vehicle’s purchase price, CO2 emissions and fuel type. |

| Cyprus | The registration tax and the annual road tax are based on CO2 emissions. |

| Czech republic | Not CO2‐based but a surcharge is levied in addition to the registration tax for vehicles not complying with at least Euro 3 emission standard. |

| Denmark | The annual circulation tax (“Green owners tax”) is based on fuel consumption: – Petrol cars: semi‐annual rates vary from DKK 330 (Danish Kroner) for cars driving at least 50km per litre of fuel to DKK 11,430 for cars driving less than 4.5km per litre of fuel. – Diesel cars: semi‐annual rates vary from DKK 130 for cars driving at least 56,3km per litre of fuel to DKK 16,720 for cars driving less than 5.1km per litre of fuel. -LNG or biogas cars: rates are the same as for diesel cars. |

| Finland | The registration tax is based on CO2 emissions: rates vary from 3.3% to 50%. The tax will be reduced in four steps between 2016 and 2019 for cars with CO2 emissions of 141g/km or less. The annual circulation tax is based on CO2 emissions for cars registered since 1 January 2001 (total mass up to 2,500 kg) or 1 January 2002 (total mass above 2,500 kg) respectively and for vans registered since 1 January 2008. Rates varies from €106.21 to €654.44. The excise duties for road traffic fuels are dependent on the energy content and CO2 emissions of the fuel. |

| France | CO2 based bonus‐malus system (as of 1 January 2018): – The malus is set from €50 (from 120 g CO2/km) to €10,500 (for 185g CO2/km or more). – Only vehicle (passenger car or LCV) emitting 20g CO2/km or less are eligible for the bonus. The amount of the bonus is €6,000. An additional bonus of €200 is granted when a vehicle of at least 15 years old is scrapped. An additional scrapping scheme is in place for diesel cars registered in 2006 or before (the maximum bonus is €2,500 for emissions of 20g CO2/km or less). For passenger cars registered for the first time in France as from 1 January 2009, an annual tax is introduced according to CO2 emissions. The company car tax is based on CO2 emissions. Tax rates vary from €2 for each gram emitted between 50g/km and 100g/km to €27 for each gram emitted above 250g/km. |

| Germany | The annual circulation tax for cars registered as from 1 July 2009 is based on CO2 emissions. It consists of a base tax and a CO2 tax. The base tax is €2 per 100cc (petrol) and €9.50 per 100cc (diesel) respectively. The CO2 tax is linear at €2 per g/km emitted above 95g/km. Cars with CO2 emissions below 95g/km are exempt from the CO2 tax component. |

| Greece | The registration tax is based on CO2 emissions. The CO2 emissions coefficient varies from 0.95 – for vehicles emitting up to 100g/km – to 2.00 for vehicles emitting more than 250g/km. The annual circulation tax for cars registered after 31 October 2010 is based on CO2 emissions. Rates vary from €0.90 per gram of CO2 emitted (91–100g/km) to €3.72 per gram (251g/km or more). Cars with emissions up to 90g/km are exempt. |

| Hungary | Not CO2‐based but the registration tax is based on environment protection classes in accordance with EU emission standards. |

| Ireland | The registration tax is based on CO2 emissions. Rates vary from 14% for cars with CO2 emissions of up to 80g/km to 36% for cars with CO2 emissions of 226g/km or more. VAT is deductible for cars registered after 1 January 2009 with CO2 emissions lower than 156g/km and which are primarily used (at least 60%) for business purposes. The annual circulation tax for cars registered since 1 July 2008 is based on CO2 emissions. Rates vary from €120 (0g/km) to €2,350 (226g/km or more). |

| Latvia | For passenger cars registered after 31 December 2009, road traffic tax is calculated by CO2 emissions. Rates vary from €12 (51−95g/km) to €756 (more than 350g/km). |

| Luxembourg | The annual circulation tax for cars registered after 1 January 2001 is based on CO2 emissions. Tax rates are calculated by multiplying the CO2 emissions in g/km with 0.9 for diesel cars and 0.6 for cars using other fuels respectively and with an exponential factor (0.5 below 90g/km and increased by 0.1 for each additional 10g CO2/km). |

| Malta | The registration tax is calculated as follow: sum of a percentage value (depending on CO2 emissions) multiplied by the CO2 emissions value (in g/km) multiplied by the registration value (RV) of the vehicle, plus the indicated percentage value multiplied by the length (in mm) multiplied by the registration value (RV) of the vehicle. The annual circulation tax is based on CO2 emissions and vehicle’s age. During the first five years, the tax only depends on CO2 emissions and varies from €100 for a car emitting up to 100g/km to €180 for a car emitting between 150g/km and 180g/km. |

| Netherlands | The registration tax (Belasting Personenauto’s Motorrijwielen or BPM) is calculated based on CO2 emissions. Rates vary from €2 (between 1 and 73g CO2/km) to €458 (for 163g CO2/km and more). Cars with zero CO2 emissions are exempt. As of 1 January 2018, a fixed BPM surcharge of €356 is applicable for all new passenger cars sold that have CO2 emissions of 1g/km or more. Furthermore, a diesel surcharge is applicable to vehicles with CO2 emissions of more than 63g/km (€87.38 in 2018). As of 1 January 2016, the rates of road tax (ACT) are established based on CO2 emissions, Gross Vehicle Weight, fuel type and region (province). The company car tax is based on CO2 emissions (if private use exceeds 500km per year). Rates vary from 4% of the vehicle’s catalogue value (for cars emitting 0g CO2/km) to 22% (for all the other cars). |

| Portugal | The registration tax is based on engine capacity and CO2 emissions. Rates are calculated as follows: – Lowest rates: petrol cars emitting less than to 100g/km pay € [(4.18 x CO2) – 386.00]; diesel cars emitting less than 80g/km pay € [(5.22 x CO2) – 396.88] – Highest rates: petrol cars emitting more than 195g CO/km pay € [(185.91 x CO2) – 30,183.74]; diesel cars emitting more than 160g pay € [(242.65 x CO2) – 30,235.96]. The annual circulation tax for cars registered after 1 July 2007 is based on CO2 emissions and cylinder capacity. |

| Romania | A three‐year fleet renewal scheme was launched in May 2017. It includes a scrappage program and incentive bonuses as follows: – A scrappage bonus of €1,500 is granted for scrapping a vehicle older than eight years and for the acquisition of a new vehicle with CO2 emissions lower than 130g/km. – A scrappage bonus of €1,500 as well as an Eco‐bonus of €250 (total €1,750) are granted for scrapping a vehicle older than eight years and for the acquisition of a new vehicle with CO2 emissions lower than 98g/km. – A subvention of €10,000 is granted for the purchase of a new pure electric vehicle to which €1,500 can be added for scrapping a vehicle older than eight years. -A subvention of €4,500 is granted for the purchase of a new hybrid vehicle. |

| Slovakia | Not CO2‐based but highway fees for the use of specified sections of motorways and expressways are based on Euro emission classes. |

| Slovenia | The registration tax is based on price and CO2 emissions. Rates vary from 0.5% (petrol) and 1% (diesel) respectively for cars emitting up to 110g CO2/km to 28% (petrol) and 31% (diesel) respectively for cars emitting more than 250g CO2/km. |

| Spain | The Special Tax (IEDMT, Impuesto Especial sobre Determinados Medios de Transporte) applied on the first registration is based on CO2 emissions. Rates vary from 4.75% (121‐159g/km) to 14.75% (200g/km and more). In 2016 a reduction in the payment of the company car tax apply to Euro 6 vehicle emitting less than 120g CO2/km, as well as to alternative powertrain cars. |

| Sweden | A new bonus‐malus system for incentives and taxation of light vehicles (cars and light trucks/buses) will be introduced from 1 July 2018. New vehicle registered will receive a bonus up to maximum SEK 60,000 depending on CO2 emission. The annual circulation tax is based on CO2 emissions for both cars and trucks. Under the new bonus‐malus system introduced, new cars and light trucks/buses registered from 1 July 2018 will pay a higher annual road tax (malus) the first three years based on CO2 emissions. |

| United Kingdom | The annual circulation tax for cars registered after March 2001 is based on CO2 emissions. For standard cars rates range from £0 (up to 100g/km) to £535 (above 255g/km). Additionally, a first‐year rate of registration applies since 1 April 2010. Rates vary from £10 (from 1 to 50g/km) to £2,000 (more than 255g CO2/km). Alternative fuel cars receive a £10 discount on the paid rates. The individual’s company car tax liability is set according to the CO2 emissions ratings (g/km) of the car and its fuel type. |

Source: ACEA

*Includes energy and CO2 tax

8.6 At the pump prices of petroleum in EU 28, first quarter of 2019* (€/litre)

8.6.1 At the pump prices of automotive diesel in EU countries, 2019 (€/litre)

| Austria | 1,09 |

| Belgium | 1,29 |

| Bulgaria | 1,03 |

| Croatia | 1,17 |

| Cyprus | 1,22 |

| Czech Republic | 1,12 |

| Denmark | 1,23 |

| Estonia | 1,16 |

| Finland | 1,27 |

| France | 1,22 |

| Germany | 1,15 |

| Greece | 1,27 |

| Hungary | 1,13 |

| Ireland | 1,28 |

| Italy | 1,39 |

| Latvia | 1,06 |

| Lithuania | 1,05 |

| Luxembourg | 0,96 |

| Malta | 1,18 |

| Netherlands | 1,18 |

| Poland | 1,06 |

| Portugal | 1,22 |

| Romania | 1,02 |

| Slovakia | 1,14 |

| Slovenia | 1,18 |

| Spain | 1,09 |

| Sweden | 1,39 |

| United Kingdom | 1,41 |

8.6.2 At the pump prices of premium unleaded gasoline 95 in EU countries, 2019 (€/litre)

| Prices of premium unleaded gasoline 95 RON | |

| (EUR per litre) | |

| Prices in force on 24/6/2019 | |

| All taxes included (€/ litre) | |

| Austria | 1,25 |

| Belgium | 1,42 |

| Bulgaria | 1,11 |

| Croatia | 1,34 |

| Cyprus | 1,19 |

| Czech Republic | 1,28 |

| Denmark | 1,61 |

| Estonia | 1,32 |

| Finland | 1,55 |

| France | 1,51 |

| Germany | 1,48 |

| Greece | 1,59 |

| Hungary | 1,16 |

| Ireland | 1,44 |

| Italy | 1,59 |

| Latvia | 1,28 |

| Lithuania | 1,23 |

| Luxembourg | 1,20 |

| Malta | 1,36 |

| Netherlands | 1,63 |

| Poland | 1,22 |

| Portugal | 1,49 |

| Romania | 1,17 |

| Slovakia | 1,32 |

| Slovenia | 1,31 |

| Spain | 1,30 |

| Sweden | 1,51 |

| United Kingdom | 1,42 |

Source: EC

8.7 Net charges per domestic haul by type in EU countries, 2012 (EUR/litre)

| Belgium | 3,1 | 55,2 |

| Bulgaria | 5 | 40,96 |

| Czech Republic | 7,3 | 56,32 |

| Denmark | 3,4 | 56,32 |

| Germany | 3,4 | 60,16 |

| Estonia | 49,2 | |

| Ireland | 17,5 | 64 |

| Greece | 4,8 | 52,48 |

| Spain | 3,3 | 42,24 |

| France | 3,4 | 55,04 |

| Croatia | ||

| Italy | 3 | 56,32 |

| Cyprus | ||

| Latvia | 2 | 42,24 |

| Lithuania | 2,8 | 38,4 |

| Luxembourg | 2,6 | 38,4 |

| Hungary | 3,1 | 49,2 |

| Malta | 48,64 | |

| Netherlands | 4,2 | 55,04 |

| Austria | 6,4 | 51,2 |

| Poland | 2,7 | 49,2 |

| Portugal | 3,4 | 47,36 |

| Romania | 4,4 | 39,68 |

| Slovenia | 46,08 | |

| Slovakia | 9 | 47,36 |

| Finland | 4,5 | 60,16 |

| Sweden | 4 | 65,28 |

| United Kingdom | 8,3 | 92,16 |

Source: OECD