8.1 Taxes on acquisition of motor vehicles in EU countries, April 2021

| Country | VAT* | Registration Tax |

| AT | 20% | Based on CO2 emissions (max 32% + bonus/malus) |

| BE | 21% | Based on cylinder capacity and age (Brussels-Capital) Fuel, age, emission standards and CO2 (Flanders) Cylinder capacity, age and CO2 emissions (Wallonia) |

| BG | 20% | Plate costs (BGN 25) + eco tax (BGN 160) |

| HR | 25% | Based on purchase price, CO2 emissions and fuel type |

| CY | 19% | Based on CO2 emissions and cylinder capacity |

| CZ | 21% | Registration tax (max CZK 800) + eco tax based on emission standards |

| DK | 25% | 25% of the vehicle’s taxable value up to DKK 65,000 + 85% of the value between DKK 65,000 and DKK 202,200 + 150% of the value above DKK 202,200 |

| EE | 20% | €62 (registrationlabel) + €130 (registration card) |

| FI | 24% | Based on retail value and CO2 emissions (min 2.7%, max 50%) |

| FR | 20% | Registration tax (varies by region) + CO2-based bonus/malus scheme |

| DE | 19% | Registration fees (€26.3) |

| EL | 24% | Based on net retail price, emissions technology and CO2 |

| HU | 27% | Based on cylinder capacity and emission standards |

| IE | 23% | Based on market selling price, NOX and CO2 emissions |

| IT | 22% | Based on vehicle type and horsepower + registration fees (€150.00 for new vehicles) + CO2-based bonus/malus scheme |

| LV | 21% | Registration costs (€43.93) + national resources tax (€55) |

| LT | 21% | Based on vehicle type |

| LU | 17% | Registration stamp (€50) + supplement (€24 or €50) |

| MT | 18% | Based on vehicle’s value, CO2 emissions and length |

| NL | 21% | Based on CO2 emissions and fuel efficiency |

| PL | 23% | Excise tax based on cylinder capacity (up to 18.6% of vehicle’s value) + registration fees (PLN 180.50 for cars) + identification card (PLN 75) |

| PT | 23% | Based on cylinder capacity and CO2 emissions + registrations fees (€55) + plate costs (€45) |

| RO | 19% | Registration fees (RON 40) |

| SK | 20% | Registration fees (min €33 based on vehicle’s value, engine power and age) + plate costs (€16.5) |

| SI | 22% | Based on fuel type, CO2 emissions, engine power and the environmental category defining the EURO emission standard. |

| ES | 21% | Based on CO2 emissions (max 14.75% for 200g/km or more) |

| SE | 25% | None |

Source: ACEA

8.2 Fiscal income from motor vehicles in EU selected countries, (EUR billion)

| AT € bn

2020 |

BE € bn

2019 |

DK DKK bn

2018 |

DE € bn

2019 |

ES € bn

2018 |

FI € bn

2019 |

FR € bn

2019 |

EL € bn

2019 |

IE € bn

2019 |

IT € bn

2019 |

NL € bn

2019 |

PT € bn

2019 |

SE SEK bn

2020 |

|

| VAT on vehicles, servicing/ repair parts, tyres | 3,00 | 8,00 | NA | 34,60 | 5,00 | 1,70 | 20,30 | 0,30 | 0,70 | 18,90 | 1,20 | 4,50 | 25,00 |

| Fuels & Lubricants | 5,60 | 8,70 | 17,50 | 41,90 | 21,50 | 3,80 | 43,10 | 5,50 | 3,50 | 37,30 | 10,40 | 3,50 | 43,10 |

| Sales & registration taxes | 0,50 | 0,50 | 20,70 | 20,70 | 0,90 | 2,30 | 0,30 | 1,00 | 1,90 | 2,20 | 0,70 | – | |

| Annual ownership taxes | 2,70 | 1,70 | 9,90 | 9,40 | 2,90 | 1,10 | 0,90 | 1,30 | 0,90 | 6,70 | 4,30 | 0,70 | 15,40 |

| Driving license fees | – | 0,00 | – | 0,20 | 0,10 | – | – | – | 0,00 | – | 0,30 | – | – |

| Insurance taxes | 0,40 | 1,00 | 1,50 | 5,40 | – | 0,40 | 5,30 | 0,50 | 0,10 | 3,90 | 1,20 | – | 2,90 |

| Tolls | 2,30 | 0,700 | 0,50 | 8,20 | – | 13,00 | – | – | 2,20 | 0,20 | 0,20 | 2,80 | |

| Customs duties | – | – | – | 0,20 | – | – | – | – | – | – | – | – | – |

| Other taxes | 0,40 | 0,80 | – | – | 0,80 | – | 1,60 | 0,20 | – | 5,40 | 1,80 | – | – |

| TOTAL (National currencies) | 14,90 | 21,4 | 50,10 | 99,90 | 30,80 | 7,90 | 86,40 | 8,10 | 6,20 | 76,30 | 21,50 | 9,60 | 89,20 |

| Total = EUR 398,4 bn | |||||||||||||

Source: ACEA

* lates available data; only countries for which sourced data is available are listed;

*** Euro foreign exchange reference rates at 30 March 2021; source: ECB

8.3 Revenues from environmentally related taxes in % of GDP

8.3.1 Environmental tax revenues by % of GDP in EU countries, 2019

% of GDP in EU(28) Countries

| Country code | 2019 |

| BE | 2,13 |

| BG | — |

| CZ | 2,47 |

| DK | 3,37 |

| DE | 1,77 |

| EE | 3,69 |

| IE | 1,39 |

| EL | 1,58 |

| ES | 1,77 |

| FR | 2,32 |

| HR | — |

| IT | 3,27 |

| CY | — |

| LV | 3,37 |

| LT | 1,94 |

| LU | 1,74 |

| HU | 2,28 |

| MT | — |

| NL | 3,63 |

| AT | — |

| PL | 2,44 |

| PT | 2,59 |

| RO | — |

| SI | 3,58 |

| SK | 2,02 |

| FI | 2,80 |

| SE | 2,00 |

| UK | 2,26 |

| EU 28 | 2,28 |

Source: OECD

8.3.2 Evolution of environmental tax revenues by % of GDP in EU 28, 2005-2019

Source: OECD

8.4 CO2 based motor vehicle taxes in EU countries, 2019

| Country | CO2 based motor vehicle taxes in the EU |

| Austria | A deduction of VAT is applicable for zero‐CO2 emission passenger cars. Fuel consumption/pollution tax (Normverbrauchsabgabe or NoVA) is levied on the purchase of a new car. It’s calculated as follows: [(CO2 emissions in g/km minus 90) divided by 5)] minus NoVA deduction, plus NoVA malus fee (ie €20 for each g/km of CO2 emission exceeding 250g/km). The company car tax is also based on CO2 emissions. |

| Belgium | Registration tax: – in Flanders is based on CO2 emissions as well as fuel, age and emission standards. – The Walloon Region operates a CO2‐based bonus/malus system whereby cars emitting 146g/km or more pay a penalty (max €2,500 for cars emitting more than 255g/km). -Flanders have in force the‘Zero-emission bonus’ to stimulate the purchase of zero-emission vehicles. The Flemish Government also grants a so‐called Ecology Premium to companies that invest in environmentally friendly and/or energy‐efficient technologies (www.ecologiepremie.be). The deductibility under corporate tax of expenses related to the use of company cars is linked to CO2 emissions. |

| Croatia | The first registration of a motor vehicle is subject to the payment of a special tax based on vehicle’s purchase price, CO2 emissions and fuel type. |

| Cyprus | The registration tax and the annual road tax are based on CO2 emissions. |

| Czech republic | Exemption from registration charges for BEVs and FCEVs emitting 50g CO2/km or less (upon request of a special number plate). – Environmental surcharge for vehicles that do not comply with the Euro 3 emission standard (ie not directly linked to CO2 emissions). |

| Denmark | The annual circulation tax (“Green owners tax”) is based on fuel consumption: – Petrol cars: semi‐annual rates vary from DKK 330 (Danish Kroner) for cars driving at least 50km per litre of fuel to DKK 11,430 for cars driving less than 4.5km per litre of fuel. – Diesel cars: semi‐annual rates vary from DKK 130 for cars driving at least 56,3km per litre of fuel to DKK 16,720 for cars driving less than 5.1km per litre of fuel. -LNG or biogas cars: rates are the same as for diesel cars. regargding the registration tax : Taxation differentiated based on the fuel consumption of the vehicle concerned (ie not directly linked to CO2 emissions). |

| Finland | CO2-based taxation, with rates varying from 2.7% to 50% of the catalogue value (including VAT and registration tax) of the vehicle concerned. |

| France | – CO2-based bonus/malus system: – Bonus: for vehicles (cars and vans) emitting 20g CO2/km or less (max €6,000). – Malus: from €35 (for 117g CO2/km) to €10,500 (for 191g CO2/km or more). – CO2-based scrapping scheme: incentives for scrapping a diesel vehicle and replacing it with a low-emission vehicle (less than 122g CO2/km). |

| Germany | The annual circulation tax for cars registered as from 1 July 2009 is based on CO2 emissions. It consists of a base tax and a CO2 tax. The base tax is €2 per 100cc (petrol) and €9.50 per 100cc (diesel) respectively. The CO2 tax is linear at €2 per g/km emitted above 95g/km. Cars with CO2 emissions below 95g/km are exempt from the CO2 tax component. |

| Greece | CO2-based taxation: coefficient varies from 0.95 (for vehicles emitting up to 100g CO2/km) to 2.00 for vehicles emitting more than 250g CO2/km. |

| Hungary | Not CO2‐based but the registration tax is based on environment protection classes in accordance with EU emission standards. |

| Ireland | – CO2-based taxation: rates vary from 14% for cars emitting up to 80g CO2/km (15% for diesel cars) to 36% for 226g CO2/km or more (37% for diesel cars). – 20% VAT deduction for cars registered after 01/01/2009 that emit less than 156g CO2/km and are primarily used for business purposes |

| Latvia | For passenger cars registered after 31 December 2009, road traffic tax is calculated by CO2 emissions. Rates vary from €12 (51−95g/km) to €756 (more than 350g/km). |

| Luxembourg | The annual circulation tax for cars registered after 1 January 2001 is based on CO2 emissions. Tax rates are calculated by multiplying the CO2 emissions in g/km with 0.9 for diesel cars and 0.6 for cars using other fuels respectively and with an exponential factor (0.5 below 90g/km and increased by 0.1 for each additional 10g CO2/km). |

| Malta | The registration tax is calculated as follow: sum of a percentage value (depending on CO2 emissions) multiplied by the CO2 emissions value (in g/km) multiplied by the registration value (RV) of the vehicle, plus the indicated percentage value multiplied by the length (in mm) multiplied by the registration value (RV) of the vehicle. The annual circulation tax is based on CO2 emissions and vehicle’s age. During the first five years, the tax only depends on CO2 emissions and varies from €100 for a car emitting up to 100g/km to €180 for a car emitting between 150g/km and 180g/km. |

| Netherlands | The registration tax (Belasting Personenauto’s Motorrijwielen or BPM) is calculated based on CO2 emissions. Rates vary from €2 (between 1 and 71g CO2/km) to €429 (for 157g CO2/km and more). Fixed surcharge of €360 applies to all new cars emitting 1g CO2/km or more (as of 01/01/2019). – Diesel surcharge applies to vehicles emitting more than 61g CO2/km (€88.43 in 2019). |

| Portugal | The registration tax is based on engine capacity and CO2 emissions. Rates are calculated as follows: – Lowest rates: petrol cars emitting less than to 100g/km pay € [(4.18 x CO2) – 386.00]; diesel cars emitting less than 80g/km pay € [(5.22 x CO2) – 396.88] – Highest rates: petrol cars emitting more than 195g CO/km pay € [(185.91 x CO2) – 30,183.74]; diesel cars emitting more than 160g pay € [(242.65 x CO2) – 30,235.96]. The annual circulation tax for cars registered after 1 July 2007 is based on CO2 emissions and cylinder capacity. |

| Romania | A three‐year fleet renewal scheme was launched in May 2017. It includes a scrappage program and incentive bonuses as follows: – A scrappage bonus of €1,500 is granted for scrapping a vehicle older than eight years and for the acquisition of a new vehicle with CO2 emissions lower than 130g/km. – A scrappage bonus of €1,500 as well as an Eco‐bonus of €250 (total €1,750) are granted for scrapping a vehicle older than eight years and for the acquisition of a new vehicle with CO2 emissions lower than 98g/km. – A subvention of €10,000 is granted for the purchase of a new pure electric vehicle to which €1,500 can be added for scrapping a vehicle older than eight years. -A subvention of €4,500 is granted for the purchase of a new hybrid vehicle. |

| Slovakia | Not CO2‐based but highway fees for the use of specified sections of motorways and expressways are based on Euro emission classes. |

| Slovenia | The registration tax is based on price and CO2 emissions. Rates vary from 0.5% (petrol) and 1% (diesel) respectively for cars emitting up to 110g CO2/km to 28% (petrol) and 31% (diesel) respectively for cars emitting more than 250g CO2/km. |

| Spain | The Special Tax (IEDMT, Impuesto Especial sobre Determinados Medios de Transporte) applied on the first registration is based on CO2 emissions. Rates vary from 4.75% (121‐160g/km) to 14.75% (200g/km and more). In 2016 a reduction in the payment of the company car tax apply to Euro 6 vehicle emitting less than 120g CO2/km, as well as to alternative powertrain cars. |

| Sweden | A new bonus‐malus system for incentives and taxation of light vehicles (cars and light trucks/buses) has been introduced from 1 July 2018: high-emitting vehicles pay a higher tax (malus) during the first three years. New vehicle registered will receive a bonus up to maximum SEK 60,000 depending on CO2 emission. The annual circulation tax is based on CO2 emissions for both cars and trucks. Under the new bonus‐malus system introduced, new cars and light trucks/buses registered from 1 July 2018 will pay a higher annual road tax (malus) the first three years based on CO2 emissions. |

| United Kingdom | The annual circulation tax for cars registered after March 2001 is based on CO2 emissions. For standard cars rates range from £0 (up to 100g/km) to £535 (above 255g/km). For the registration, rates vary from £10 (from 1 to 50g/km) to £2,070 (more than 255g CO2/km). Alternative fuel cars receive a £10 discount on the paid rates and Zero-emission cars are exempt. The individual’s company car tax liability is set according to the CO2 emissions ratings (g/km) of the car and its fuel type. |

Source: ACEA

8.5 Excise duties on fuels in EU countries at 1-1-2020 & 1-1-2021 (EUR/1000 litres)*

| 1 January 2020 | 1 January 2021 | % change 2020-2021 | ||||

| Unleaded Petrol | Diesel | Unleaded Petrol | Diesel | Unleaded Petrol | Diesel | |

| AT | 515 | 425 | 482 | 397 | -6,4% | -6,6% |

| BE | 600 | 600 | 600 | 600 | 0,0% | 0,0% |

| DE | 654 | 470 | 655 | 470 | 0,2% | 0,0% |

| DK | 631 | 429 | 638 | 435 | 1,1% | 1,4% |

| EL | 700 | 410 | 700 | 410 | 0,0% | 0,0% |

| ES | 504 | 379 | 504 | 379 | 0,0% | 0,0% |

| FI | 702 | 530 | 724 | 513 | 3,1% | -3,2% |

| FR | 683 | 594 | 683 | 594 | 0,0% | 0,0% |

| HR | 520 | 413 | 510 | 405 | -1,9% | -1,9% |

| IE | 602 | 495 | 619 | 515 | 2,8% | 4,0% |

| IT | 728 | 617 | 728 | 617 | 0,0% | 0,0% |

| LU | 472 | 355 | 516 | 404 | 9,3% | 13,8% |

| NL | 800 | 503 | 813 | 522 | 1,6% | 3,8% |

| PT | 643 | 486 | 668 | 513 | 3,9% | 5,6% |

| SE | 619 | 436 | 643 | 452 | 3,9% | 3,7% |

| BG | 363 | 330 | 363 | 330 | 0,0% | 0,0% |

| CY | 429 | 400 | 429 | 400 | 0,0% | 0,0% |

| CZ | 499 | 425 | 477 | 370 | -4,4% | -12,9% |

| EE | 563 | 493 | 563 | 372 | 0,0% | -24,5% |

| HU | 366 | 338 | 345 | 317 | -5,7% | -6,2% |

| LT | 466 | 372 | 466 | 372 | 0,0% | 0,0% |

| LV | 509 | 414 | 509 | 414 | 0,0% | 0,0% |

| MT | 549 | 472 | 549 | 413 | 0,0% | -12,5% |

| PL | 383 | 337 | 374 | 330 | -2,3% | -2,1% |

| RO | 373 | 342 | 375 | 344 | 0,5% | 0,6% |

| SI | 547 | 469 | 445 | 464 | -18,6% | -1,1% |

| SK | 555 | 393 | 514 | 368 | -7,4% | -6,4% |

| EU 27 average | 555 | 442 | 552 | 434 | -0,6% | -1,7% |

Source: ACEA

*Includes energy and CO2 tax

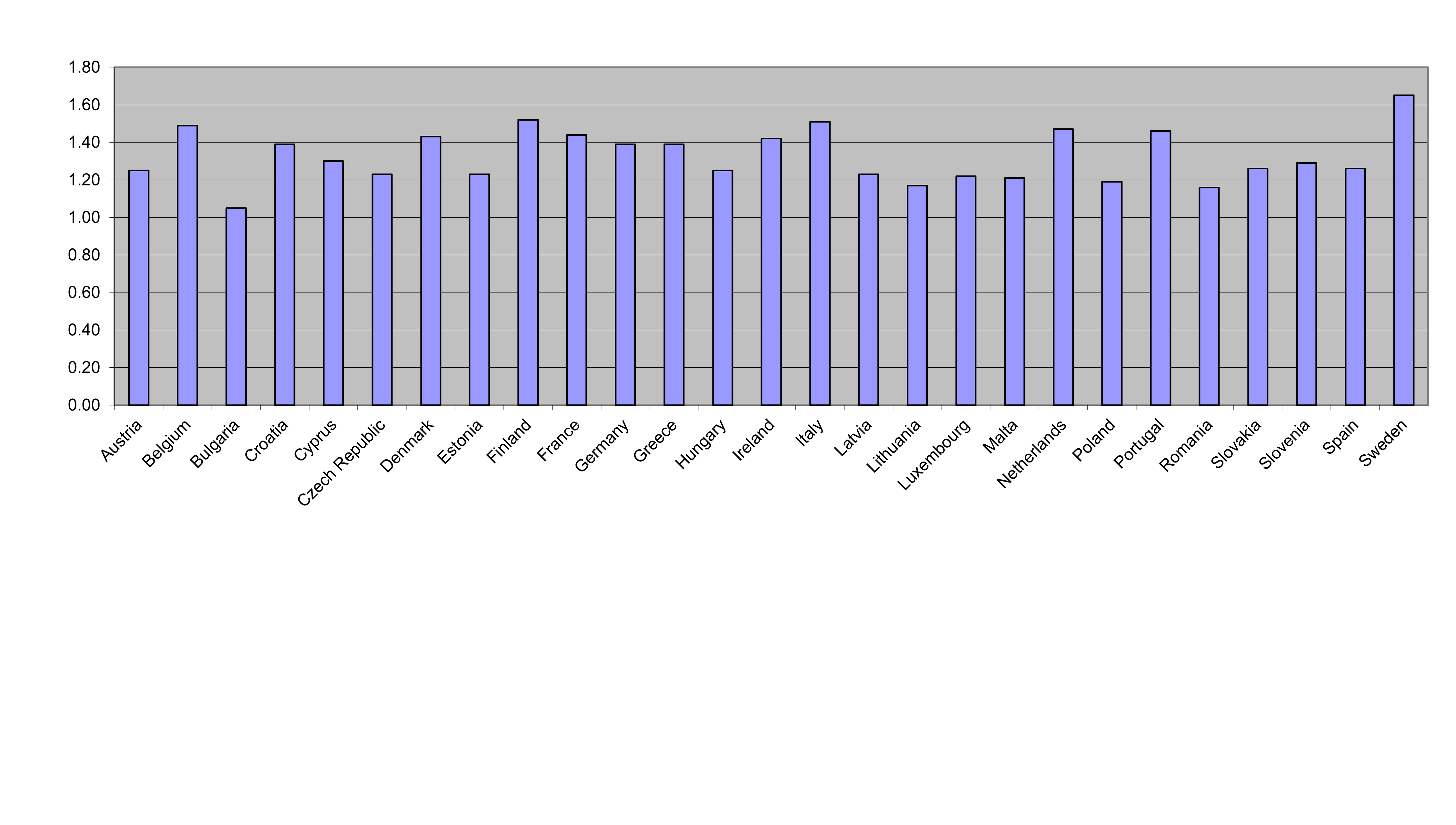

8.6 At the pump prices of petroleum in EU 28, first semester of 2021* (€/litre)

8.6.1 At the pump prices of automotive diesel in EU countries, 2021 (€/litre)

| Price of automotive gas oil (diesel oil )(EUR per litre) | Prices in force on 12/7/2021 All taxes included (€/ litre) |

| Austria | 1,25 |

| Belgium | 1,49 |

| Bulgaria | 1,05 |

| Croatia | 1,39 |

| Cyprus | 1,30 |

| Czech Republic | 1,23 |

| Denmark | 1,43 |

| Estonia | 1,23 |

| Finland | 1,52 |

| France | 1,44 |

| Germany | 1,39 |

| Greece | 1,39 |

| Hungary | 1,25 |

| Ireland | 1,42 |

| Italy | 1,51 |

| Latvia | 1,23 |

| Lithuania | 1,17 |

| Luxembourg | 1,22 |

| Malta | 1,21 |

| Netherlands | 1,47 |

| Poland | 1,19 |

| Portugal | 1,46 |

| Romania | 1,16 |

| Slovakia | 1,26 |

| Slovenia | 1,29 |

| Spain | 1,26 |

| Sweden | 1,65 |

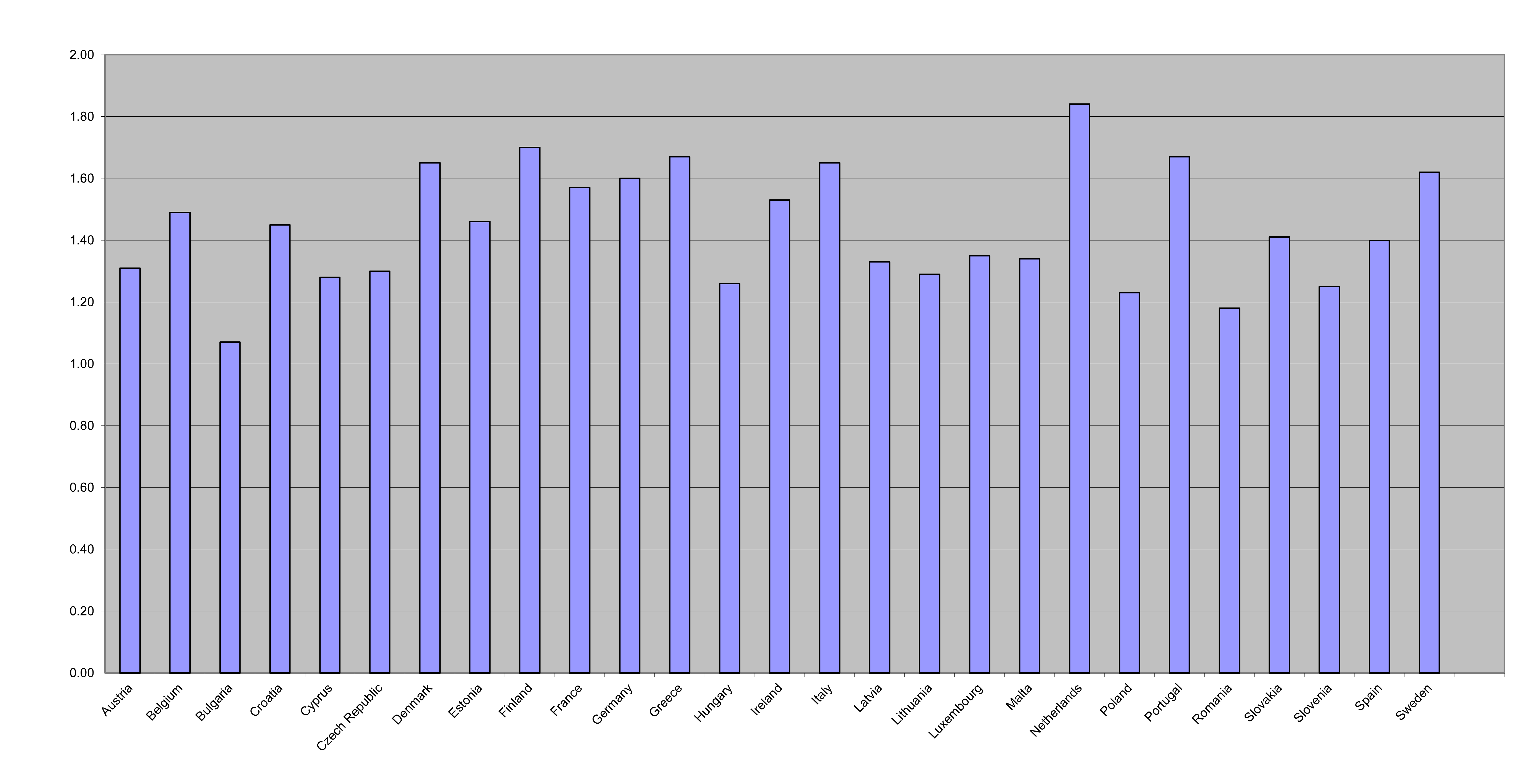

8.6.2 At the pump prices of euro-super 95 in EU countries, 2021 (€/litre)

| Prices of euro-super 95(EUR per litre) | Prices in force on 12/7/2021 All taxes included (€/ litre) |

| Austria | 1,31 |

| Belgium | 1,49 |

| Bulgaria | 1,07 |

| Croatia | 1,45 |

| Cyprus | 1,28 |

| Czech Republic | 1,30 |

| Denmark | 1,65 |

| Estonia | 1,46 |

| Finland | 1,70 |

| France | 1,57 |

| Germany | 1,60 |

| Greece | 1,67 |

| Hungary | 1,26 |

| Ireland | 1,53 |

| Italy | 1,65 |

| Latvia | 1,33 |

| Lithuania | 1,29 |

| Luxembourg | 1,35 |

| Malta | 1,34 |

| Netherlands | 1,84 |

| Poland | 1,23 |

| Portugal | 1,67 |

| Romania | 1,18 |

| Slovakia | 1,41 |

| Slovenia | 1,25 |

| Spain | 1,40 |

| Sweden | 1,62 |

Source: EC